Opticien

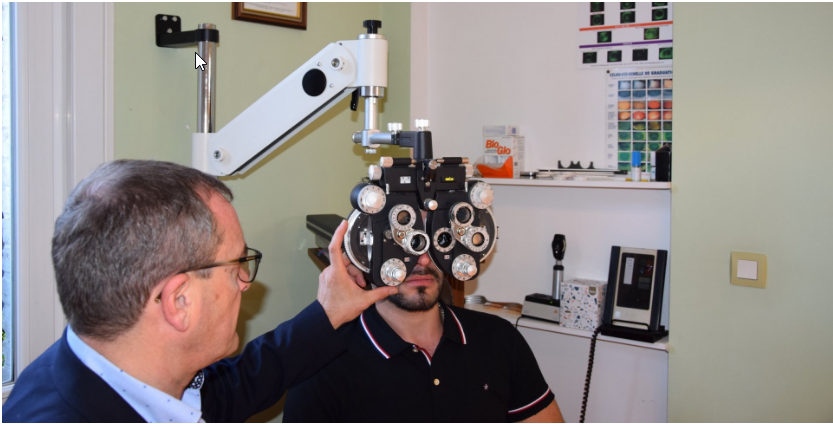

Votre opticien, expert en optométrie pour le confort de votre vision

Notre valeur ajoutée est certainement notre compétence en optométrie : M. Bourgeois n’est pas qu’opticien mais diplômé de la maîtrise des sciences et techniques, spécialité en optométrie physiologique, optique de contact et optométrie de l’université d’Orsay Paris Sud, ce qui lui rend un rôle d’expert en santé visuelle.

Nous sommes certifiés

74 ans d'éxpérience

Pourquoi nous ?

Pourquoi faire confiance à notre centre de vision ?

Conseils d'opticien adaptés à chacun

Grand choix de montures Femme Homme Enfant

Tout type de lentilles de contact

Carte de fidélité pour vous offrir toujours plus

Lunettes

Tous nos services pour votre vision : lunette, lentille, verre

Vous avez besoin de changer vos lunettes de vue ? Votre opticien, M. Bourgeois, sera à votre écoute afin de vous apporter un conseil professionnel pour vous aider à choisir aussi bien votre monture, adapté à votre vue et la forme de votre visage, que les verres adaptés. Nous distribuons en majorité des montures OFG (Origine France Garantie) ou fabrication Europe. Notre stock est rigoureusement sélectionné par M. Bourgeois pour sa fiabilité, son design, son mode de fabrication, sa conception technique afin d’épouser le visage.

Expertise

Besoin d'un examen visuel ?

Vous voulez une consultation ?